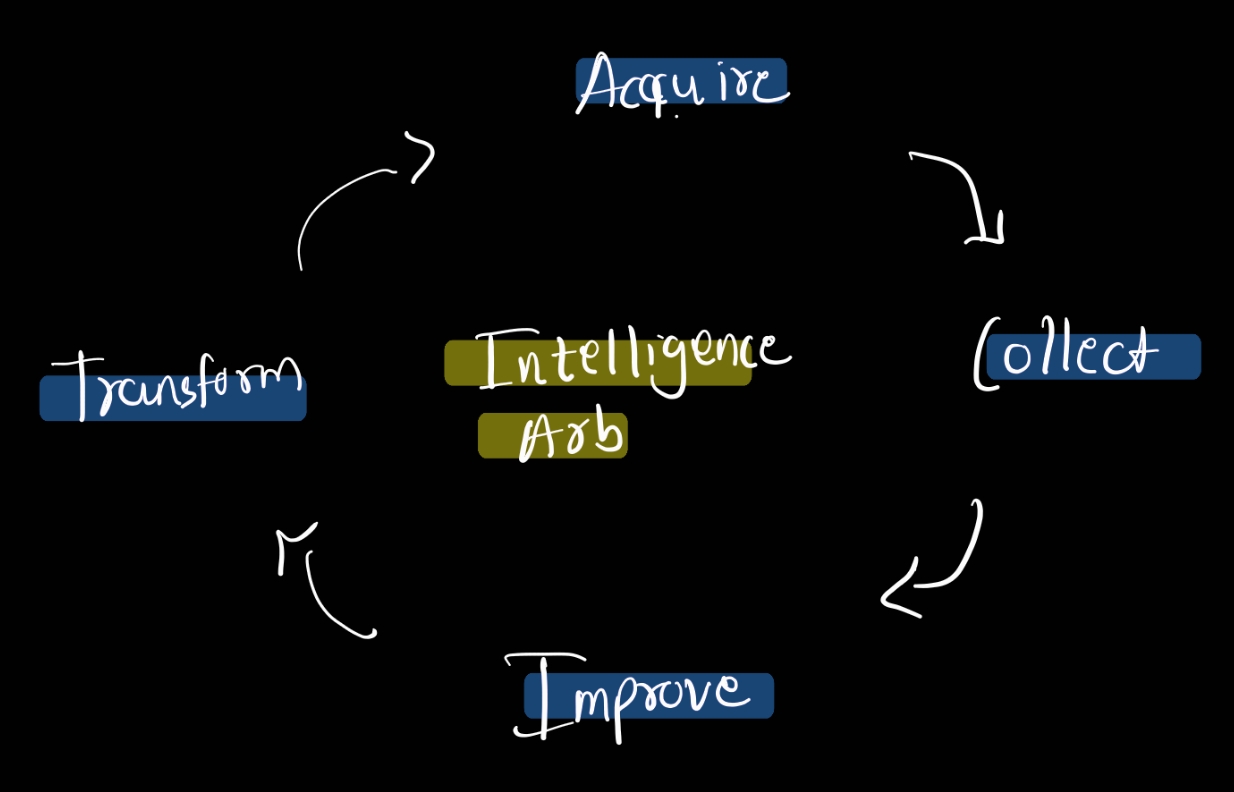

intelligence margin arb

every decade or so, a new playbook emerges that reshapes how we think about scaling businesses. not in the way trends come and go, but in the way fundamental shifts force everyone to play a different game.in the 2000s, qualcomm figured out how to license IP instead of manufacturing chips. in the 2010s, aws made infrastructure something you rented, not owned. now, in 2024, we’re watching the biggest shift yet: the separation of intelligence from service delivery.

this time, the playbook isn’t coming from silicon valley. it’s being written by investors who see ai as more than just automation—it’s operating leverage on steroids.

the move: separate the “intelligence layer” from service execution. in law, ai is replacing research and contract drafting. in medicine, ai-driven diagnostics are outpacing human radiologists. in finance, underwriting models are being trained to make faster, more precise lending decisions.

model aggregation

company x is turning traditional service firms into ai-driven machines. instead of selling ai tools, they acquire legacy businesses—small, founder-run, and behind on tech—for 1-2x revenue. these firms come with customers and untapped data. the play: repurpose the workforce from service execution to data labeling. human effort fuels better models, reducing costs and expanding margins. over time, ai takes over the heavy lifting, and what was once a low-margin business starts compounding like software. they’ve crossed $10m in revenue, and every acquisition makes them stronger. private equity is watching—because this isn’t just automation, it’s a shift in control. the ones who move first won’t just profit; they’ll own the intelligence layer itself.

buyouts

company y started as a software solution for independent dental practices—helping small clinics manage bookings, insurance claims, and compliance. but scaling saas in healthcare is slow. dentists don’t like switching systems, and selling one by one takes forever. so they changed the game. instead of waiting for adoption, they started buying the clinics themselves—rolling up local dental offices under one umbrella, standardizing operations, and layering in their software. overnight, revenue multiplied. margins expanded. ai-driven diagnostics, automated billing, and centralized scheduling turned what used to be a fragmented industry into an efficiency machine. now they control both the infrastructure and the intelligence layer. no need to sell software when you can own the entire workflow. the old model was software-as-a-service. this is software-as-an-empire.

vertical play

company z raised $100m—not to build, but to buy. instead of the slow grind of scaling saas, they rolled up senior living facilities, consolidating like a pe firm but with a different playbook. the tech stack wasn’t just a bolt-on—it was the operating core. patient intake, staff scheduling, and revenue cycle management all ran through their platform. then they layered on ai: voice-to-voice models for automated calls, text-based systems for outpatient care coordination. margins went from 15% to 25% fast. traditional pe rollups focus on efficiency. this one focused on intelligence. each acquisition didn’t just add locations—it added data, refining the models, sharpening operations, making every next move stronger. what started as a fragmented service business is now an ai-powered operating system for an entire industry.

2010s: build software that solves a problem and sell it to other businesses. 2024: build software that buys businesses. whether you start with models and use acquisitions for data, compete with pe firms, or create a tech-enabled aggregation, the most interesting part isn’t the technology—it’s how these deals get structured and funded.

the real opportunity isn’t just in building ai or buying companies. it’s in creating entirely new financial structures that can turn the $25t services market into tomorrow’s software businesses. that’s the intelligence arbitrage.

thanks to udit j, khushi s, sahil k, rujuta k, krish s, hritik t for their inputs and helping me w the review and edit of this note.

Sources